"iBuyer" & other employee based non-agent services

In general we have all become much more comfortable buying (and selling) “products” online

Especially since Covid, most of us feel we can reliably get what we paid for when it comes to “products”: There’s no longer a dubious sense of great risk, and we know that we can confidently return most items or at least get much of what we paid minus shipping. (Admittedly I have gotten screwed by Dell multiple times when I tried to get a faulty brand new laptop replaced).

“Services” online do not enjoy that reputation

How many of you have purchased assistance from an editor, designer, programmer, etc where they lied about what they can do, they are late, they don’t complete or do crappy work, maybe they ran off with your money, your time was wasted, and if you paid you won’t get your money back. (This has happened to me countless times with editors, web designers, referral agents etc).

Much of this is due to the fact that they feel they have impunity because without having been referred by a person of consequence, like people in your own sphere of influence, their reputation is not at risk. Even then, it still happens!

look no farther for proof than from your basic services

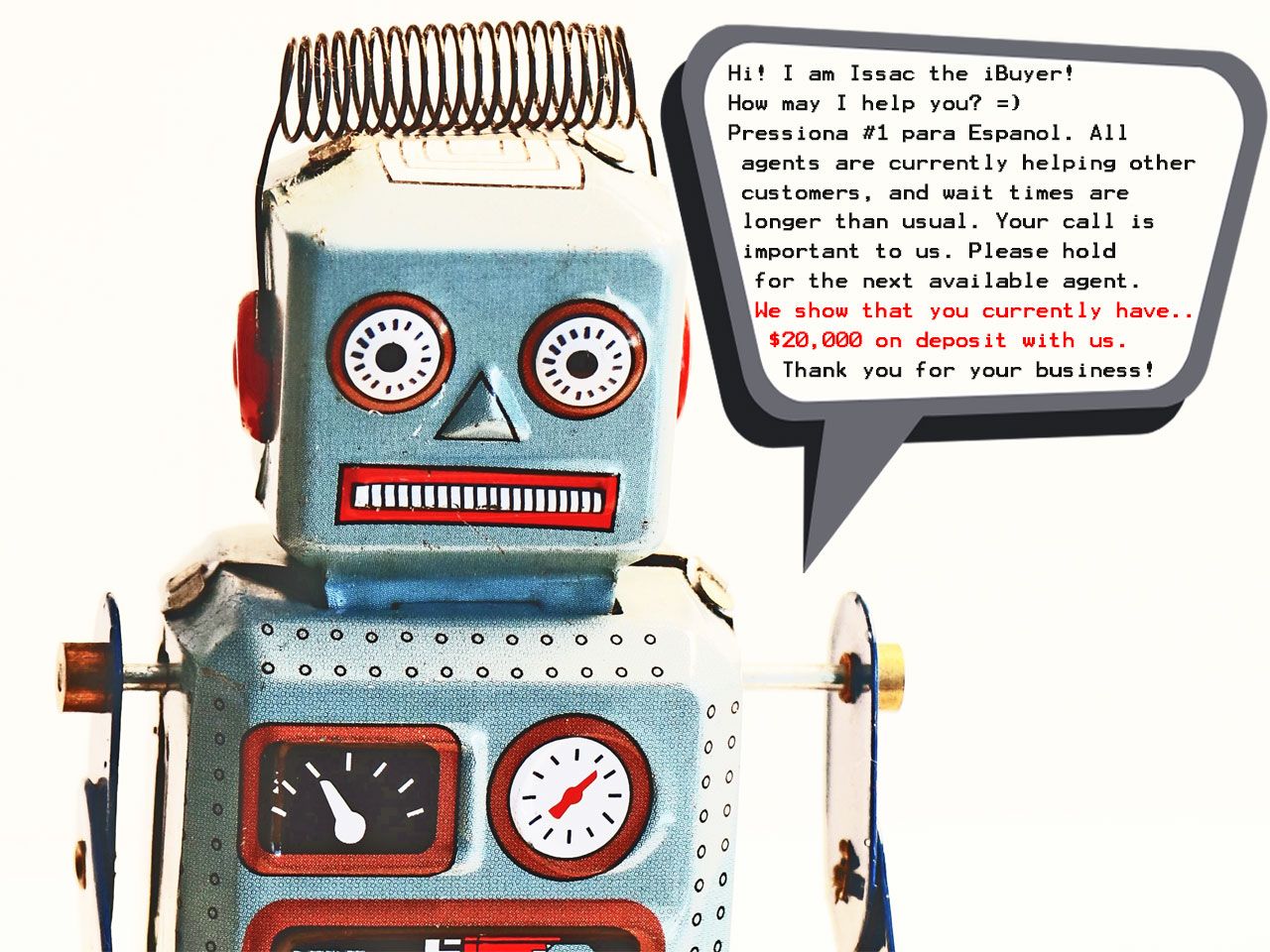

Consider your own experience resolving ANY simple issue, (unexpected charges or delivery), for basic services like utilities, cable, phone, a prescription, or insurance. It's a freakin boondoggle.“….para espanol marque dos”, and other prolonged telephone gymnastics abound while on an eternal hold, disconnected, or talking to the wrong person, who then retransfers you to yet another auto attendant where you have to leave a message. If you are clever and outwit the system you might actually get someone who you are still not certain is even relevant, and at best they respond days later (but usually don't respond at all).

What consequence does a loan officer employee at a financial institution bear if they do not perform or secure a mortgage for a buyer? None, because they are still paid a salary (and even a bonus) regardless of YOUR outcome. Impersonal, Corporate, No recourse, No disincentive for poor performance.

Most of you have become familiar with non-agent home sales

For those unfamiliar, we are referring to the iBuyer and "flat fee" offerings that have you focused on the meager savings of not using a professional, (which is only paid if it sells).

these services have you distracted from the substantial losses in the areas you are NOT paying attention to: Price reductions, credits, and low offers related to being in a weak negotiation position from being uprepared and uninformed.

Now consider iBuyer – does that model help you get more money?

iBuyer programs like Opendoor, Offerpad, Redfin Now, Zillow offers (now closed)

Some move fast

Not available in all states

You can typically select the closing date from 24 hours to 90 days (you can be certain that 24 hours will be at a deep discount)

These companies don't charge Realtor commissions. Instead, they charge other fees and have additional conditions, all of which may reduce what you get by an amount that well exceeds what you would have paid an investor or agent, and FAR exceeds what you would have given up to an investor. Typically from 6%-13% plus closing, costs which may be inflated and additional fees added so as not to disincentivize the closing agent.

- Service charges

- Estimated closing costs

- Required repairs

Homes must be owner-occupied or vacant, and not have a tenant or a friend or family member inhabiting the property.

Offers are typically non-negotiable and may add in additional fees if an inspection shows your home needs repairs.

Typical issues that might cause you to end up paying additional fees include:

- Electrical

- Plumbing

- HVAC

- Roofing

- Mold

- Pest issues

- Lead-paint

- Health hazards

Requesting an offer from is typically free with no obligation to work with them. If you accept the offer they schedule an inspection. The inspector will determine if your house needs any repairs, and, if so, estimate the costs. Opendoor will then send you a final offer, reducing the price based on the cost of repair work. If the repair estimate comes in too high, for example, some of these types of offers permit you to back out of selling without forfeiting money. Others do not. In most cases, a seller is not legally obligated to fix anything on the home. Some states stipuate which party needs to bring the property up to current specifications on items such as:

- Smoke detectors

- Carbon monoxide detectors

- Water heater straps

- Automatic gas shut-off valves

- Other retrofit items

Usually the seller is responsible for bringing the home up to current codes (unless otherwise specified). If not done prior to closing, the seller will be in breach of contract.

What is their purchase contingent on

As the seller

iBuyer WAS (until 2022) a Zillow owned program where THEY bought your house. Obviusly they were only be buying it from you at a price at which they could ASSURE they would make a handsome profit. As you might expect, the amount you get is nowhere near the price you imagine and costs you multiple times more than what you would have paid any real estate professional to do the whole thing right at the highest price.Sellers who would even consider this service fall in to either one or both of the following catoegories:

- Have lot to repair or replace and either may not have available cash or an equity loan to sufficiently address whats needed, and are unaware of the other options that exist

- Don't care about giving away a substantial portion of their proceeds so long as they dont have to do ANYTHING

As the buyer

The service is more like Craigslist, but for bigger transactions and risk. How comfortable are you transferring a $20,000 or more deposit where the conditions are no clearer then for any traditional brick-and-mortar services done with a person? Have you ever had to dispute a large charge with the BBB? How comfortable are you tying up and putting at risk hundreds of thousands of dollars when the successof the transaction is in the hands of salaried employees who:- Are virtual: you wont ever meet them and it's really difficult to reach them

- Can't give (you shouldn't accept) relevantadvice since they are not licensed financial advisers, CPAs, attorneys, or in most cases not even licensed real estate professionals

- Work remotely and are unfamiliar with the market in general

- Are ufamiliar with and don’t study the market

- Never actually see the property being bought or sold or the surrounding area

Are you going to take a negotiation consultation or advice from an employee working for the same beaurocratic corporation that owns the property and is also selling the property? If not, who is representing you?Having spoken with people on the buy side of an iBuyer transaction I learned that they, and atleast one other family were both told that their offer was accepted over a week prior, when the "2 day post-expiration deadline" had passed. You dont even know about that deadline do you. Here's a question: Did they even know what they were getting in the end?The two families couldn't tell me because didn't even know WHAT they signed.

Home buying firm settles deceptive marketing claims for $62 million.

The Federal Trade Commission accused Opendoor of deceiving customers into offering their properties to the online platform for less than they would have made on the open market.

https://www.nytimes.com/2022/08/01/business/opendoor-homes-deceptive-marketing.html?smid=url-share

Real estate transactions have many moving parts:

- changes that occur during the contract to close process that need to be worked out

- conditions that you are not familiar with that need to be understood

- complications you will have to be aware of that need to be addressed

- issues you don’t know about that will appear and cause you to seek changes

- detailed terms and agreements that leave hundreds of thousands of dollars at risk

Shall I assume you will resolve the aforementioned issues on the phone with the above salaried employees? It's like buying a foreclosed property at an auction, but: Joey from Friends is advising you, you are not getting a deal, and the single authority is the very real estate company who owns it and is selling it. God knows how much the seller leaves on the table from such an imaginary convenience.

A real estate transaction is still a marriage not a fight

Its a temporary marriage whose ceremony will inevitably encounter one or more problems, requiring one or both sides to offer some flexibility or concession to close, and its not going to work out well if you've been selfish, belligerent, adversarial, or synical.Both sides may change during the transaction

Either side may run into a speed bump. There is no “iSolution” because to keep the transaction together without stringent penalties or financial loss it may require from ALL PARTICIPANTS human problem solving, reprioritization, and consideration of different approaches and outcomes. Is that what you expect to get from the salaried Zillow employee? You'll never even see them, let alone meet them.What automated services CAN benefit you?

The widening and matching of opportunities and options, the management and responsiveness of frequent communications, and the tracking and sharing of progress. That’s what we have done at RealPlaces, and in effect that benefits both the buyer AND the seller. Here’s an idea: Why not use an investor or FULL-TIME agent whose resources, industry experience, and market knowledge HELP YOU by placing YOU in the best position to get YOU the best outcome.Conclusion

Aren't we all in the best position when the interests of those helping us are aligned with our own? How can that occur when the risk WE take IS INFINITELY HIGHER than the risk and consequences of the Zillow employee who we never even meet personlly, wasn't referred to us by a colleague, and decides to leave Zillow one day and work for Craigs List?Unlike zillow, investors, brokers and agents:

- own their own business

- live in your area and know the same people, so their reputation and consequence to their performance

- are only paid IF YOUR goal is achieved and the transaction comes to fruition

- value referrals because it is the basis for (lifeblood of) their ongoing business stability and growth

Zillow employees cant benfit from referrals anyway because they are unable to use them to build their business - because it isnt their business to build.